-

Supply Chain and Operation Services

An optimised and resilient supply chain is essential for success in an ever-evolving business landscape

-

Business risk services

The relationship between a company and its auditor has changed. Organisations must understand and manage risk and seek an appropriate balance between risk and opportunities.

-

Marketing and Client Service

We offer strategy, client service, digital and insight solutions to businesses that are shaping the future across the Middle East.

-

Forensic services

At Grant Thornton, we have a wealth of knowledge in forensic services and can support you with issues such as dispute resolution, fraud and insurance claims.

-

Transaction Advisory

Globalisation and company growth ambitions are driving an increase in transactions activity worldwide. We work with entrepreneurial businesses in the mid-market to help them assess the true commercial potential of their planned acquisition and understand how the purchase might serve their longer-term strategic goals.

-

Growth services

We have designed and developed growth services to support your business at each phase of its growth. So whether you are an SME that has just set up or a large business wishing to expand, at Grant Thornton we will help you unlock your potential for growth.

-

IFRS

At Grant Thornton, our IFRS advisers can help you navigate the complexity of financial reporting.

-

Audit quality monitoring

Having a robust process of quality control is one of the most effective ways to guarantee we deliver high-quality services to our clients.

-

Global audit technology

We apply our global audit methodology through an integrated set of software tools known as the Voyager suite.

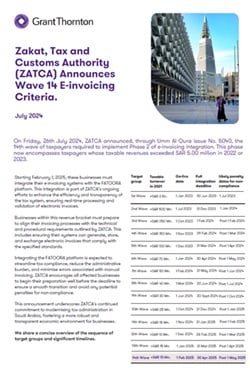

Starting February 1, 2025, these businesses must integrate their e-invoicing systems with the FATOORA platform. This integration is part of ZATCA’s ongoing efforts to enhance the efficiency and transparency of the tax system, ensuring real-time processing and validation of electronic invoices.

Businesses within this revenue bracket must prepare to align their invoicing processes with the technical and procedural requirements outlined by ZATCA. This includes ensuring their systems can generate, store, and exchange electronic invoices that comply with the specified standards.

Integrating the FATOORA platform is expected to streamline tax compliance, reduce the administrative burden, and minimise errors associated with manual invoicing. ZATCA encourages all affected businesses to begin their preparation well before the deadline to ensure a smooth transition and avoid any potential penalties for non-compliance.

This announcement underscores ZATCA's continued commitment to modernising tax administration in Saudi Arabia, fostering a more robust and transparent economic environment for businesses.

Review the full schedule below.