-

Supply Chain and Operation Services

An optimised and resilient supply chain is essential for success in an ever-evolving business landscape

-

Business risk services

The relationship between a company and its auditor has changed. Organisations must understand and manage risk and seek an appropriate balance between risk and opportunities.

-

Marketing and Client Service

We offer strategy, client service, digital and insight solutions to businesses that are shaping the future across the Middle East.

-

Forensic services

At Grant Thornton, we have a wealth of knowledge in forensic services and can support you with issues such as dispute resolution, fraud and insurance claims.

-

Transaction Advisory

Globalisation and company growth ambitions are driving an increase in transactions activity worldwide. We work with entrepreneurial businesses in the mid-market to help them assess the true commercial potential of their planned acquisition and understand how the purchase might serve their longer-term strategic goals.

-

Growth services

We have designed and developed growth services to support your business at each phase of its growth. So whether you are an SME that has just set up or a large business wishing to expand, at Grant Thornton we will help you unlock your potential for growth.

-

IFRS

At Grant Thornton, our IFRS advisers can help you navigate the complexity of financial reporting.

-

Audit quality monitoring

Having a robust process of quality control is one of the most effective ways to guarantee we deliver high-quality services to our clients.

-

Global audit technology

We apply our global audit methodology through an integrated set of software tools known as the Voyager suite.

Our ‘Insights into IFRS 3’ series summarises the key areas of the Standard, highlighting aspects that are more difficult to interpret and revisiting the most relevant features that could impact your business.

This article discusses how goodwill, or a gain from a bargain purchase is initially recognised and measured under IFRS 3, which represents the final step of applying the acquisition method.

Goodwill is defined in Appendix A to IFRS 3 as an asset representing the future economic benefits arising from other assets acquired in a business combination that are not individually identified and separately recognised but that the acquirer controls via its power to direct the policies and management of the acquiree. Goodwill cannot be measured directly and can only be recognised when a business combination occurred. It is viewed as a residual and as such is measured as the excess of one amount over another.

A bargain purchase is when a business is acquired for less than its fair market value, resulting in a gain for the acquirer.

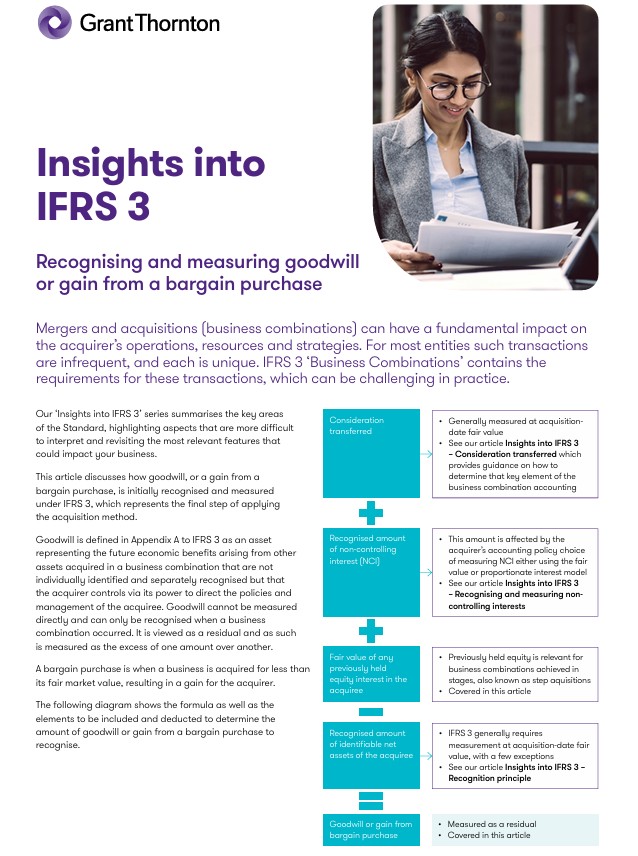

The following diagram shows the formula as well as the elements to be included and deducted to determine the amount of goodwill or gain from a bargain purchase to recognise.

Three of the elements included in the above formula are discussed in the relevant articles as noted. Our article ‘Insights into IFRS 3 – Recognising and measuring non-controlling interest’ discusses how the NCI measurement options might impact the amount of goodwill to recognise.

We also note that when recognising goodwill as a result of a business combination, the goodwill is required to be allocated to one or multiple cash generating units (CGUs). This is addressed in our article ‘Insights into IFRS 3 – Accounting after the acquisition date’.

Therefore, this article covers:

- situations where the acquirer has previously held an equity interest in the acquiree, and

- accounting for goodwill or gain from a bargain purchase.

Business combination achieved in stages

Prior to a business combination, the acquirer may already own an equity interest in the acquiree (which may have been accounted for under IAS 28 ‘Interests in Associates and Joint Ventures’, IFRS 11 ‘Joint Arrangements’ or IFRS 9 ‘Financial Instruments’). When the acquirer obtains control over the acquiree, this existing investment is viewed as part of what is given up when obtaining control.

Consequently, the existing investment is derecognised as if the acquirer disposed of it at fair value, and a related gain or loss is recognised in profit or loss or in other comprehensive income (OCI) (ie on the same basis as would be required if the acquirer had disposed directly of the previously held interest). This situation is commonly referred to as a business combination achieved in stages or a step acquisition.

In a step acquisition, any other income or expense that had been recognised in OCI when the previously held interest was accounted for using the equity method are also recycled to profit or loss on the same basis as if the underlying items to which they relate were directly derecognised.

There are also more considerations when the previously held interest was classified as an associate or a joint venture (JV) that was accounted for using the equity method. The acquirer will be required to perform a fair value exercise for all the assets acquired and liabilities assumed, as at the date of acquisition. This means that:

- The assets recognised under the new accounting may include assets that were not previously included in the equity accounting of the associate or JV

- The value of assets previously recognised in the equity accounting calculation require remeasurement and may change from what was previously recorded

The following examples illustrate the accounting for business combinations achieved in stages:

Example 1 - Acquirer had an existing investment accounted for under IAS 28

Entity A owns a 35% interest in Entity B. The investment, with an original cost of CU50, is accounted for as an associate using the equity method. On 30 December 20X4, the carrying value of the investment in Entity B was CU230 and its fair value was CU308. The fair value of Entity B's identifiable net assets on that date was CU800.

On 31 December 20X4, Entity A purchased an additional 40% interest in Entity B in cash for CU352, thereby obtaining control with a 75% interest in Entity B. Entity A opted to measure NCI at fair value, which was determined to be CU220.

Determining goodwill:

The difference between the fair value and the carrying value of the investment in the associate of CU78 (CU308 - CU230) is recognised as a gain in profit or loss.

Example 2 – Acquirer had an existing investment accounted for under IFRS 9

Entity X holds a 10% investment in Entity Y, which was purchased for CU100 at 1 January 20X5. The investment is measured at fair value with changes in fair value recognised in other comprehensive income (FVOCI) in accordance with IFRS 9. On 31 December 20X9, the investment has a fair value of CU250. On the same day, Entity X purchased the remaining 90% of Entity Y's shares for a cash consideration of CU2,250, increasing its interest to 100% and obtaining control.

The fair value of the identifiable net assets of Entity Y at the acquisition date was CU2,100.

Determining goodwill:

The change in the fair value of investment classified as FVOCI amounting to CU150 (CU250 – CU100) is transferred directly to retained earnings as if Entity X had directly disposed of its investment.

Determining goodwill or a gain from a bargain purchase

Applying IFRS 3's formula may result in a positive amount (goodwill) or a negative amount (gain from a bargain purchase). These amounts are accounted for differently and disclosure requirements are also different.

See our article ‘Insights into IFRS 3 – Disclosures under IFRS 3: Understanding the requirements’ for more details of the differences of disclosure between goodwill and a gain from a bargain purchase.

A gain from a bargain purchase is expected to arise relatively infrequently and can normally be attributed to specific commercial factors such as a forced sale by the vendors. Before recognising a bargain purchase gain, IFRS 3 specifically requires the acquirer to review:

- whether all of the assets acquired and liabilities assumed have been identified, and

- the related accounting measurements.

Elements of the business combination requiring review:

- identifiable assets acquired and liabilities assumed (to determine as to whether assets are not overstated or liabilities understated or even missing as a result of the fair value exercise)

- NCI in the acquiree, if any

- acquirer's previously held equity interest in the acquiree in a business combination achieved in stages, if any, and

- consideration transferred (eg whether the consideration transferred includes the acquisition date fair value of earn-out clauses).

The objective of reviewing the above items is to ensure that the measurements used to determine a bargain purchase gain reflect all available information as of the acquisition date. The acquirer should also consider whether there are any preexisting relationships that were settled as part of the business combination.

How we can help

We hope you find the information in this article helpful in giving you some insight into IFRS 3. If you would like to discuss any of the points raised, please contact us directly.